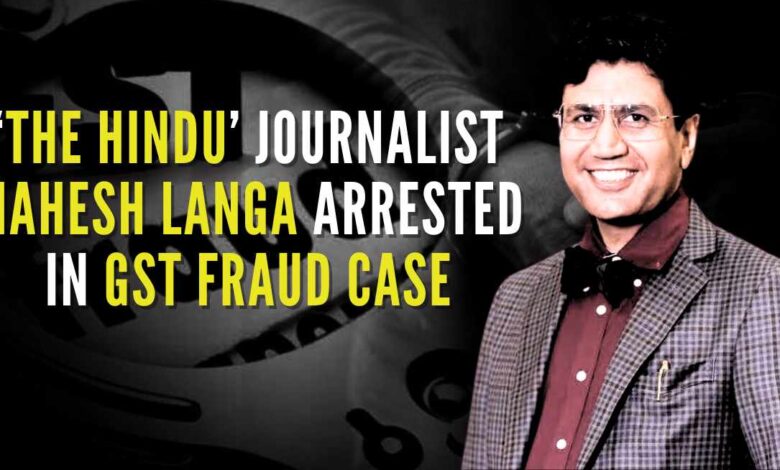

In another shocking turn of events, Mahesh Langa, a well-known Gujarati journalist has been arrested in connection with an immense GST fraud case. The present case has really set the fringes of the media fraternity into serious shock and poses a valid question as to why influential persons are increasingly getting themselves entangled in financial crimes. People were shocked by the arrest of Langa who was also known for his honesty as well as hard-hitting journalism.

The Case of Alleged Scam and Detention

According to the official reports, Mahesh Langa was detained following a series of investigations into a ring of people suspected to be involved in a “fraudulent scheme meant to evade the Goods and Services Tax” or GST. It is claimed that Langa was one of the key players in making imaginary GST transactions in an effort to avoid tax liability and launder money.

The authorities searched Langa’s house, from where they retrieved around Rs 20 lakh in unaccounted cash. This cash, according to investigators, was the fruit of illegal GST credits and transactions, having added substantial evidence to the case. During the search, documents related to multiple shell companies were recovered, pointing towards his involvement in dubious financial activities.

The GST scam is suspected to involve adultery with the creation of fictitious invoices, fraudulent claim of input tax credit, a common technique of large-scale tax evasion cases. The manipulation of the GST invoice leads not only to massive financial loss to the government but also distorts fair business competition.

How the GST Fraud Was Executed

The fraud so allegedly operated by Langa and his friends consisted of paper companies. These bogus companies issued false invoices over goods or services never supplied or rendered. It so happens that as they managed to claim input tax credit over such fraud transactions, this helped them in not paying taxes and appropriating the difference.

There were many of the kind wherein the customer had developed layers and layers of fictitious transactions over a series of companies to mask fraudulent operations. Investigators have observed that Langa had leveraged his network and influence to allow the fraudulent operations to remain under wraps for so long. Increased crackdown by the Indian government on GST frauds led to an extensive review of high-value transactions, which eventually exposed the involvement of Langa.

The GST department had upped the ante of such enforcement actions. And Langa is just one of the very high-profile arrests that have taken place in the recent months. Possessing significant evidence, investigators are confident that the case will lead to further arrests and expose additional layers of the fraudulent network.

Rs 20 Lakh Seized

The Rs 20 lakh in unaccounted cash recovered from Langa’s house only raised more questions than answers. Investigating the money’s origin, the investigators believe it to be the proceeds from the GST scam. Though large in amount, it may be at best just the tip of the iceberg as more raids are likely to take place in the coming days.

The cash seized has deepened the investigation by coming with a trail that authorities must try to follow to know the actual scope of fraud. Preliminary investigations indicate that Langa might have been part of a syndicate feeding on loopholes in the GST system. The syndicate may have benefited through fake invoices and fraudulent claims to siphon huge sums of money, and the journalist was a key facilitator.

Mishandling the Management: Mahesh Langa Role and Media Backlash

The arrest of a well known journalist like Mahesh Langa has brought up quite many debates in media today. He was a veteran journalist, who never shied from raising questions on most the important political and social issues. It is very well highlighted, that how the influential people being related to financial crimes can have a dark potential side which may imply no profession as above moral bounds.

While evidence continues to mount against him, Langa has denied the misdoings. His lawyers claim that the money found at his house had nothing to do with the fraudulent schemes that were under investigation and was apparently a ruse to nail him within the case. Still, the authorities are tightlipped about the charges and have pointed a wide range of evidence linking him to the fraudulent operations.

In fact, this has not been missed by the media, but the reactions are not positive and welcome. A significant percentage defend Langa, saying he’s always been a voice of truth and justice, while others hold the view that he is surrounded by hypocrisy in most of the high-profile figures.

This case has heightened debate on a larger level about the integrity of public figures about such matters and their role in creating public opinion. More now are questioning the ethics of those who are expected to be watchdogs of society but who may, in reality, be working behind the scenes on illegal activities.

GST Fraud in India: A Growing Concern

Among the many recent GST fraud cases that have surfaced and highlighted the extent of fraudulent GST practices in tax evasion, one incident is Mahesh Langa’s arrest. Since the Indian government successfully implemented GST in 2017, it has been faced with a large number of challenges in checking tax evasion. Fake invoice scams and input tax credit claims mostly remained fraudulent, resulting in large-scale loss of revenue.

However, in the wake of various grounds resulting from the GST Council and also individual state governments imposing stricter rules and regulations, along with improved auditing and data-sharing mechanisms between various departments, this problem can not solely be attributed to this reason, as it results in numerous fraudulent operations due to the inability of catching hold of the grounds behind these manipulations, more so in instances where the so-called fraudulent operations concern powerful individuals.

Conclusion

Mahesh Langa’s arrest in the GST fraud case and Rs 20 lakh cash seized has sent shock waves all over the nation, and this case puts forth many questions about the integrity of public persons. The case will go down as a landmark, where the failures of the law enforcement agencies are brought to life in cracking down on white-collar crimes, with a special emphasis on the powerful. As more details come in clear light of probe, it would bring corruption and financial fraud into the open – not only the current one but probably a larger network.

Arrest – The Wake-Up Call for the Value of Responsibility As a Professional: It will surely have wide-ranging implications for India in its fight against GST fraud in the process of making India’s tax structure stronger.